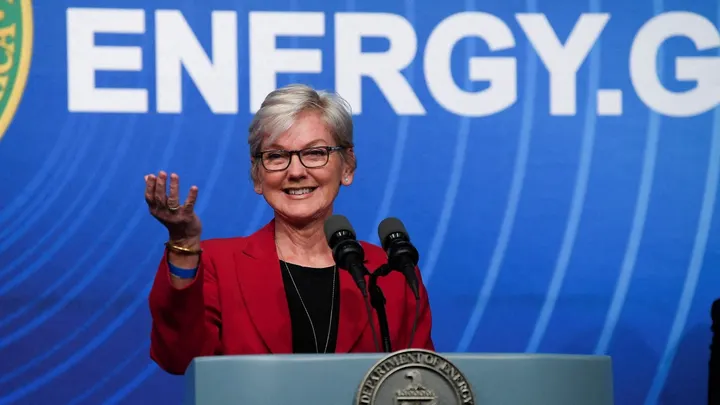

The withdrawal of a $200 million grant from Microvast, an energy technology firm, by the Department of Energy has sparked concerns among Republicans. Sen. John Barrasso, a prominent member of the Energy and Natural Resources Committee, wasted no time in expressing his unease and seeking answers from Energy Secretary Jennifer Granholm.

The sudden decision has had significant repercussions on the market, with Microvast’s share price experiencing a surge of over 40% after the grant announcement, only to plummet by 36% after its withdrawal. Sen. Barrasso finds it inappropriate, if not unethical, for the federal government to have such a substantial impact on the stock price of a single company.

Demanding transparency and accountability, Barrasso has called for information regarding the award negotiations with Microvast and other selectees, as well as the award processes employed by the Department. The lack of clarity surrounding these processes has caused confusion and uncertainty among investors.

The initial announcement in October, where the Biden administration allocated $2.8 billion to 20 companies, including Microvast, aimed to bolster domestic manufacturing. However, the grant was ultimately withdrawn, with the DOE clarifying that the October announcement was only the beginning of negotiations and not a guaranteed award.

Concerns have also been raised regarding Microvast’s heavy reliance on China, with 69% of their revenue generated in the country. These ties, combined with the Chinese government’s influence over the company’s activities, raise significant national security concerns.

Sen. Barrasso highlights the misleading nature of the White House and the Department of Energy’s press releases, which have contributed to confusion among investors. It is crucial for the Department to respond and provide clarity on its decision-making processes, ensuring transparency and restoring confidence in its actions.